Form 1099-INT for 2023

Get NowForm 1099-INT for 2023: How-To Guide

When people earn income from interest, it's important to know about the 1099-INT tax form. In a few words, 2023 Form 1099-INT is a statement provided by banks and other financial institutions to both taxpayers and the IRS, indicating the amount of interest income received during the year. It covers various types of interest, from savings accounts to bonds and dividends.

Significance of the 1099-INT in Tax Filing

Taxpayers must report all their income accurately, including interest earned. The 1099-INT is crucial because it helps ensure that all interest income is accounted for when filing taxes. Receiving this form means you have additional information that must be included in your tax return.

Form 1099-INT: Changes and Updates for 2023

As tax laws change, so do reporting requirements. It's essential to be aware of the latest updates for the tax year 2023 to avoid mistakes that could lead to penalties. Understanding these changes helps taxpayers prepare their tax documents properly and file them on time.

- Legislative Updates Affecting Interest Income Reporting

Tax legislation may impact how you report interest income from different sources. In 2024, these updates could influence the data you need to provide and the way you fill out your 2023 IRS Form 1099-INT. - Adjustments to Thresholds and Exemptions

Each year, the IRS may adjust thresholds for reporting interest income. These changes mean that the amount of interest you earn could affect whether or not you need a 1099-INT tax form for 2023. Make sure to review these adjustments to determine if you pass the threshold that requires reporting - Relevant IRS Notices and Updates

The IRS regularly issues notices and updates that clarify or modify certain aspects of tax filing. Paying attention to these can prevent errors and ensure compliance with the current standards for reporting interest income on your 2023 tax forms.

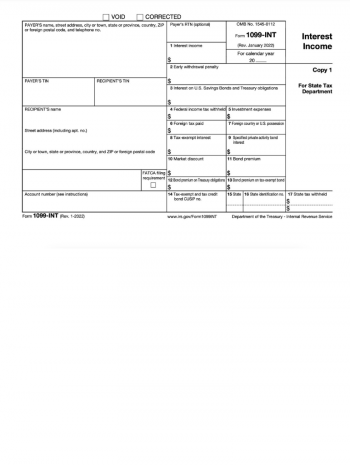

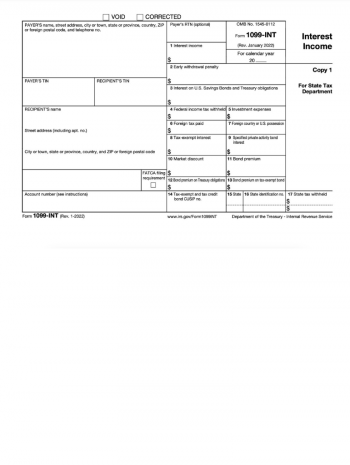

The 1099-INT form for 2023 documents the interest income you received that year. It has several boxes that will typically indicate various types of interest earned and any related expenses or foreign taxes paid.

Changes in Form Structure and Layout

Occasionally, there might be changes in the form's structure or layout, which could affect where you report certain types of interest or additional information. Carefully review the 1099-INT fillable form for 2023 to avoid placing information in the wrong section.

Important Modifications to Reporting Requirements

The IRS might also introduce modifications to reporting requirements that influence what needs to be reported. These changes can include the addition of new sources of interest income that must be disclosed or perhaps changes in the way existing income is classified.

Recipients of the 1099-INT for the Tax Year 2023

- Individuals Receiving Interest Income

If you've received income from interest, you are likely to receive a 2023 1099-INT form printable. This form is evidence of the interest income you must declare on your return. Individuals in various investment scenarios will see this form included in their tax paperwork. - Entities and Accounts Covered by the 1099-INT

Not only individuals but also entities like trusts and estates may receive a 2023 1099-INT form. This form covers accounts such as savings, money market accounts, and more, showing the interest accrued over the year. - New Inclusions or Exclusions for 2023

Each year might bring new inclusions or exclusions regarding who must receive the Form 1099-INT for 2023 and what accounts it pertains to. These updates are essential to identify anyone newly required to report interest income or conversely, who may no longer need to do so.

Filling Out the 1099-INT for 2023

- Personal Information: Your name, address, and Social Security number or tax identification number.

- Interest Income Details: The total amount of interest earned in the tax year and any relevant expenses.

- Payer Information: The entity that paid you the interest, including its name and tax identification number.

Adjustments to Reporting Guidelines

New guidelines may be implemented that affect how and where you report information on your 1099-INT tax form. Always verify the instructions accompanying the form to understand these new requirements.

Tips for Accurate and Timely Submission

Ensuring accuracy on your form is paramount to avoid conflicts with the IRS. Double-check all entries before submission, and be aware of the tax deadline to submit your forms timely. Online resources, including guides and the 2023 1099-INT form printable, can assist you in this process.

Reporting and Tax Implications for 2023

Taxpayers must include information from their 2023 1099-INT tax form when preparing their federal returns. This information can affect the calculation of taxable income and must be factored into the appropriate sections of the tax return form.

Taxable vs. Non-taxable Interest Income: New Considerations

Not all interest income is taxable. It's essential to differentiate between the two, as the 2023 tax year may bring new considerations regarding what qualifies as non-taxable interest.

Anticipated Impact of Form 1099-INT on Tax Liability

Finally, understanding how your interest income influences your overall tax liability is critical. While completing your IRS Form 1099-INT for 2023, keep in mind that this could affect the amount of tax you owe or the size of your refund.

Remember, when dealing with tax forms like the 1099-INT, accuracy and attention to detail are your best allies. Use the latest information available to ensure you're up to date with all changes and requirements for the tax year 2023.

Related Forms

-

![image]() 1099-INT If you earn interest from bank accounts, investments, or loans you've made, you might need to know about IRS Form 1099-INT. This important document is used to report interest income you've received during the year to you and the Internal Revenue Service (IRS). It's critical because any interest income you earn could be subject to taxes, and the IRS requires this information to ensure the correct tax amount is reported and paid. Fill Now

1099-INT If you earn interest from bank accounts, investments, or loans you've made, you might need to know about IRS Form 1099-INT. This important document is used to report interest income you've received during the year to you and the Internal Revenue Service (IRS). It's critical because any interest income you earn could be subject to taxes, and the IRS requires this information to ensure the correct tax amount is reported and paid. Fill Now -

![image]() 1099-INT Tax Form Printable Managing your taxes includes knowing about various forms and documents. Among these, the 1099-INT tax form printable is significant for reporting interest income. In this article, we provide guidance on why this form is essential and how to get a copy for your records and use. Importance of the 1099-INT Form in Tax Filing The IRS requires individuals to report all their income, including interest earned throughout the year. The free printable 1099-INT tax form plays a crucial role in this task. It helps to ensure your income is reported accurately to the federal government. We aim to equip you with valuable insights into Form 1099-INT printable. With clear instructions, we'll show you how to access the 2023 1099-INT form printable version and guide you through filling it out correctly. Understanding the 1099-INT Tax Form The 1099-INT is a document sent by financial institutions to taxpayers who have earned interest from deposits or investments during the tax year. It’s the standard way to report income from interest to the Internal Revenue Service (IRS). Typically, if you've earned more than $10 in interest from a bank, brokerage, or another financial entity, you'll receive a 1099-INT. It’s important for the IRS to track the 1099-INT printable form of income, and thus, it requires detailed reporting. Key Information Included in the Form Interest Income: The total amount of earned interest. Payer Information: Details of the institution that paid the interest. Account Information: Your account number, which helps identify where the interest came from. Printable Version of the 1099-INT You can find the printable IRS Form 1099-INT on the IRS website or through our platform. We make sure that the current year's forms are available and that the 1099-INT form is free and printable. Having a printable tax form 1099-INT is beneficial for record-keeping and helps in case electronic systems fail or you need to correct information manually before filing. Steps for Accessing and Printing the Form Online PlatformsYou can download the 1099-INT form printable from our website or other tax-related resources. Financial InstitutionsYour bank or investment firm may provide you with the ability to print Form 1099-INT directly from their website. Requesting a Copy from the PayerIf you haven't received one, ask the institution that paid you interest for a copy. Filling Out the Printable 1099-INT Form Required Information Personal InformationInclude your name, address, and tax identification number. Interest IncomeAccurately report the interest income as reflected on your statements. Payer InformationEnsure the payer's name and federal identification number are correct. Mistakes can lead to processing delays or even penalties. Double-check your numbers and consult with a tax professional if you're unsure. Tips for Accuracy To maintain accuracy, reconcile your income with your bank statements. Keep a neat record of all related documents, and don't hesitate to reach out for help when needed. Now that you know how to print the 1099-INT form and its importance, you can confidently handle your interest income reporting. Should you need further clarification or assistance, professional advice is always recommended. Remember, staying on top of your tax obligations by making use of a free printable 1099-INT form simplifies the process and gives you peace of mind. Be sure to file your taxes with care, and good luck! Fill Now

1099-INT Tax Form Printable Managing your taxes includes knowing about various forms and documents. Among these, the 1099-INT tax form printable is significant for reporting interest income. In this article, we provide guidance on why this form is essential and how to get a copy for your records and use. Importance of the 1099-INT Form in Tax Filing The IRS requires individuals to report all their income, including interest earned throughout the year. The free printable 1099-INT tax form plays a crucial role in this task. It helps to ensure your income is reported accurately to the federal government. We aim to equip you with valuable insights into Form 1099-INT printable. With clear instructions, we'll show you how to access the 2023 1099-INT form printable version and guide you through filling it out correctly. Understanding the 1099-INT Tax Form The 1099-INT is a document sent by financial institutions to taxpayers who have earned interest from deposits or investments during the tax year. It’s the standard way to report income from interest to the Internal Revenue Service (IRS). Typically, if you've earned more than $10 in interest from a bank, brokerage, or another financial entity, you'll receive a 1099-INT. It’s important for the IRS to track the 1099-INT printable form of income, and thus, it requires detailed reporting. Key Information Included in the Form Interest Income: The total amount of earned interest. Payer Information: Details of the institution that paid the interest. Account Information: Your account number, which helps identify where the interest came from. Printable Version of the 1099-INT You can find the printable IRS Form 1099-INT on the IRS website or through our platform. We make sure that the current year's forms are available and that the 1099-INT form is free and printable. Having a printable tax form 1099-INT is beneficial for record-keeping and helps in case electronic systems fail or you need to correct information manually before filing. Steps for Accessing and Printing the Form Online PlatformsYou can download the 1099-INT form printable from our website or other tax-related resources. Financial InstitutionsYour bank or investment firm may provide you with the ability to print Form 1099-INT directly from their website. Requesting a Copy from the PayerIf you haven't received one, ask the institution that paid you interest for a copy. Filling Out the Printable 1099-INT Form Required Information Personal InformationInclude your name, address, and tax identification number. Interest IncomeAccurately report the interest income as reflected on your statements. Payer InformationEnsure the payer's name and federal identification number are correct. Mistakes can lead to processing delays or even penalties. Double-check your numbers and consult with a tax professional if you're unsure. Tips for Accuracy To maintain accuracy, reconcile your income with your bank statements. Keep a neat record of all related documents, and don't hesitate to reach out for help when needed. Now that you know how to print the 1099-INT form and its importance, you can confidently handle your interest income reporting. Should you need further clarification or assistance, professional advice is always recommended. Remember, staying on top of your tax obligations by making use of a free printable 1099-INT form simplifies the process and gives you peace of mind. Be sure to file your taxes with care, and good luck! Fill Now -

![image]() 1099-INT Fillable Form When you earn interest from a bank, a company, or another financial institution, they might need to report this information to you and the Internal Revenue Service (IRS) using a 1099-INT form. This document is crucial as it reflects the interest income you've received during the year, which you must report on your tax returns. Recipients of the 1099-INT Form You should expect a 1099-INT form if you have received interest payments of at least $10. This doesn't just include interest from savings accounts but also from bonds, Treasury bills, and other investments. Understanding who should receive this form helps you recognize if your financial activity requires it during tax season. Key Components of the Form In a few words, Form 1099-INT fillable outlines several key details that you need to provide to the IRS. Interest IncomeThis is the main reason for the form – to disclose any interest earned. Payer InformationIt includes the name and contact details of the institution or individual who paid the interest. Account DetailsInformation about the specific account that has earned the interest is also needed. The Fillable 1099-INT Form An IRS Form 1099-INT fillable version is readily available online for tax year 2023. This is a convenient tool that makes the process of reporting interest income easier and less time-consuming. The 1099-INT fillable PDF brings numerous benefits, such as reducing the risk of errors and providing an easily navigable platform for entering your information. A free fillable 1099-INT form often includes interactive fields and instructions, simplifying the completion process. Step-by-Step Guide to Filling Out the 1099-INT Fillable Form To complete the 1099-INT fillable form for 2023 accurately, you’ll need some specific pieces of information. Personal DetailsYour name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) must be included. Interest IncomeAccurately report your interest income in the appropriate boxes on the form. Payer InformationThis includes the payer's name, address, and tax identification number. Interactive Features of the Fillable Form The 1099-INT fillable form has interactive fields that guide you through each step, ensuring that you input all the necessary information correctly and efficiently. Once you have filled out the 1099-INT fillable form, you can save it to your computer. It’s important to print a copy for your records and to send it to the IRS if you're not filing electronically. Tips for Accuracy and Completeness Common Mistakes to AvoidBe sure to double-check all the information on your fillable 1099-INT form before submission. Ensure that all taxpayer identification numbers are correct and match the numbers on your tax documents. Verifying Information Before SubmissionBefore sending the form to the IRS, cross-check the interest income reported by the payer with your own records. Discrepancies should be addressed with the payer before filing. If you have any doubts or questions while completing the form, the IRS provides resources and guidance that can be easily accessed online. E-Filing Options E-filing is a method to submit tax forms, including a 1099-INT form fillable version, directly to the IRS online. It’s a secure and efficient way to handle your tax reporting. Benefits of E-Filing the 1099-INT E-filing a 1099-INT PDF fillable form expedites the processing of your tax information and ensures that the IRS receives your form promptly. Several third-party platforms are approved by the IRS for e-filing. Ensure that the service you choose is compatible with the IRS fillable 1099-INT form standards. Remember, it's essential to be thorough and accurate when dealing with tax forms to avoid any potential issues with the IRS. Using the fillable versions of the 1099-INT forms can help streamline this process and provide an error-free way to report your interest income. Fill Now

1099-INT Fillable Form When you earn interest from a bank, a company, or another financial institution, they might need to report this information to you and the Internal Revenue Service (IRS) using a 1099-INT form. This document is crucial as it reflects the interest income you've received during the year, which you must report on your tax returns. Recipients of the 1099-INT Form You should expect a 1099-INT form if you have received interest payments of at least $10. This doesn't just include interest from savings accounts but also from bonds, Treasury bills, and other investments. Understanding who should receive this form helps you recognize if your financial activity requires it during tax season. Key Components of the Form In a few words, Form 1099-INT fillable outlines several key details that you need to provide to the IRS. Interest IncomeThis is the main reason for the form – to disclose any interest earned. Payer InformationIt includes the name and contact details of the institution or individual who paid the interest. Account DetailsInformation about the specific account that has earned the interest is also needed. The Fillable 1099-INT Form An IRS Form 1099-INT fillable version is readily available online for tax year 2023. This is a convenient tool that makes the process of reporting interest income easier and less time-consuming. The 1099-INT fillable PDF brings numerous benefits, such as reducing the risk of errors and providing an easily navigable platform for entering your information. A free fillable 1099-INT form often includes interactive fields and instructions, simplifying the completion process. Step-by-Step Guide to Filling Out the 1099-INT Fillable Form To complete the 1099-INT fillable form for 2023 accurately, you’ll need some specific pieces of information. Personal DetailsYour name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) must be included. Interest IncomeAccurately report your interest income in the appropriate boxes on the form. Payer InformationThis includes the payer's name, address, and tax identification number. Interactive Features of the Fillable Form The 1099-INT fillable form has interactive fields that guide you through each step, ensuring that you input all the necessary information correctly and efficiently. Once you have filled out the 1099-INT fillable form, you can save it to your computer. It’s important to print a copy for your records and to send it to the IRS if you're not filing electronically. Tips for Accuracy and Completeness Common Mistakes to AvoidBe sure to double-check all the information on your fillable 1099-INT form before submission. Ensure that all taxpayer identification numbers are correct and match the numbers on your tax documents. Verifying Information Before SubmissionBefore sending the form to the IRS, cross-check the interest income reported by the payer with your own records. Discrepancies should be addressed with the payer before filing. If you have any doubts or questions while completing the form, the IRS provides resources and guidance that can be easily accessed online. E-Filing Options E-filing is a method to submit tax forms, including a 1099-INT form fillable version, directly to the IRS online. It’s a secure and efficient way to handle your tax reporting. Benefits of E-Filing the 1099-INT E-filing a 1099-INT PDF fillable form expedites the processing of your tax information and ensures that the IRS receives your form promptly. Several third-party platforms are approved by the IRS for e-filing. Ensure that the service you choose is compatible with the IRS fillable 1099-INT form standards. Remember, it's essential to be thorough and accurate when dealing with tax forms to avoid any potential issues with the IRS. Using the fillable versions of the 1099-INT forms can help streamline this process and provide an error-free way to report your interest income. Fill Now -

![image]() IRS Form 1099-INT Instructions Understanding who should receive a 1099-INT is crucial. This document is typically sent to individuals who have earned interest income throughout the year. It's important to recognize that not all interest earnings require a 1099-INT, as the IRS sets minimum thresholds. Our article is a simplified version of the IRS instructions for the 1099-INT to help you concentrate on the most vital parts. Individuals Receiving Interest Income If you've earned interest from bank accounts, investments, or loans you made, you might get a 1099-INT. This form will outline the interest you need to report on your tax return. The magic number to remember is $10. If you've earned more than that in interest, you should expect a 1099-INT. Entities that pay interest, like banks or businesses, are responsible for sending out this form if they've paid you above this threshold. Common Scenarios Requiring a 1099-INT Interest from savings accounts Earnings from certificates of deposit (CDs) Interest from treasury bonds or other government securities Key Components of the 1099-INT Form The 1099-INT form instructions detail the specific components taxpayers must understand before filling it out. It primarily consists of information related to the interest earned and the entity that paid the interest. Interest Income InformationThis section includes the total amount of taxable interest. You'll also find details of any penalties charged for early withdrawal of funds. Payer DetailsThis part of the form highlights who is paying the interest. It is usually a financial institution or corporation. Account InformationYou'll find account numbers or other identifiers here, enabling both you and the IRS to match the interest income with your specific account. Understanding the Sections of the Form Now, let's delve into how to read the different sections of the form according to the provided IRS 1099-INT instructions. Section 1: Personal InformationThis section includes your name, address, and tax identification number—information that identifies you to the IRS. Section 2: Interest IncomeHere, you'll see boxes detailing various types of interest earnings, such as tax-exempt interest or certain types of bond premiums. Section 3: Payer InformationThis area contains the payer's contact information, which can be helpful if there are any discrepancies that need to be resolved. Filling Out the 1099-INT Form Filling out the form accurately is essential. Instructions for Form 1099-INT guide you through each step, ensuring you provide the correct information. Step-by-Step Guide to Completing the Form The process begins with your personal information and then moves on to the various types of interest earned throughout the year. Each box has a specific purpose and requires careful attention. Double-check each entry against your financial records. Ensure that the totals add up correctly and that your personal details match those on file with the IRS. Common Mistakes to Avoid Mistakes can include incorrect taxpayer identification numbers, mismatched names, or incorrect interest amounts. Thoroughly review the form before submission to prevent any issues with your taxes. Differentiating Taxable and Non-taxable Interest IncomeThe instructions for the 1099-INT form help differentiate between taxable and non-taxable interest. Not all interest income must be included in your taxable income, so knowing the difference is key. Identifying Taxable InterestMost interest is taxable, such as that earned from banks or from loans you've provided. Ensure you report it accurately on your tax return. Recognizing Exclusions and ExceptionsCertain types of interest may be exempt from taxes, like some government bonds or qualified education savings accounts. Knowing these exceptions is vital to avoid overpaying taxes. Impact on Tax Liability Correctly identifying and reporting your interest will impact how much you owe or how large your refund might be. Make sure to follow IRS instructions for Form 1099-INT closely to determine what applies to your situation. Electronic Options for 1099-INT Submission E-filing your taxes has become a widely accepted method of submission, and this includes forms like the 1099-INT. E-filing is often faster and more secure than paper filing. It can also reduce errors since many e-filing systems have built-in checks for common mistakes. Multiple options exist for e-filing, ranging from IRS-approved websites to tax preparation software. Ensure the platform you choose supports e-filing for the 1099-INT. Step-by-Step Guide to E-Filing E-filing usually involves creating an account, entering your tax information into the prescribed fields, and then submitting your form electronically. The system will generally guide you through this process, minimizing confusion. If you are having trouble or have questions about your 1099-INT, resources are available to help. For example, our website offers comprehensive IRS Form 1099-INT instructions and answers to common questions. Addressing Challenges in Understanding the Form If instructions for the 1099-INT are still unclear or if there are unique circumstances not covered by general guidance, it may be beneficial to consult a tax professional. They can provide personalized assistance tailored to your specific tax situation. While dealing with tax forms can be overwhelming, having a clear understanding of instructions for the 1099-INT can simplify the process and ensure accuracy in tax reporting. Always take your time, check your work, and don't hesitate to seek professional help when necessary. Fill Now

IRS Form 1099-INT Instructions Understanding who should receive a 1099-INT is crucial. This document is typically sent to individuals who have earned interest income throughout the year. It's important to recognize that not all interest earnings require a 1099-INT, as the IRS sets minimum thresholds. Our article is a simplified version of the IRS instructions for the 1099-INT to help you concentrate on the most vital parts. Individuals Receiving Interest Income If you've earned interest from bank accounts, investments, or loans you made, you might get a 1099-INT. This form will outline the interest you need to report on your tax return. The magic number to remember is $10. If you've earned more than that in interest, you should expect a 1099-INT. Entities that pay interest, like banks or businesses, are responsible for sending out this form if they've paid you above this threshold. Common Scenarios Requiring a 1099-INT Interest from savings accounts Earnings from certificates of deposit (CDs) Interest from treasury bonds or other government securities Key Components of the 1099-INT Form The 1099-INT form instructions detail the specific components taxpayers must understand before filling it out. It primarily consists of information related to the interest earned and the entity that paid the interest. Interest Income InformationThis section includes the total amount of taxable interest. You'll also find details of any penalties charged for early withdrawal of funds. Payer DetailsThis part of the form highlights who is paying the interest. It is usually a financial institution or corporation. Account InformationYou'll find account numbers or other identifiers here, enabling both you and the IRS to match the interest income with your specific account. Understanding the Sections of the Form Now, let's delve into how to read the different sections of the form according to the provided IRS 1099-INT instructions. Section 1: Personal InformationThis section includes your name, address, and tax identification number—information that identifies you to the IRS. Section 2: Interest IncomeHere, you'll see boxes detailing various types of interest earnings, such as tax-exempt interest or certain types of bond premiums. Section 3: Payer InformationThis area contains the payer's contact information, which can be helpful if there are any discrepancies that need to be resolved. Filling Out the 1099-INT Form Filling out the form accurately is essential. Instructions for Form 1099-INT guide you through each step, ensuring you provide the correct information. Step-by-Step Guide to Completing the Form The process begins with your personal information and then moves on to the various types of interest earned throughout the year. Each box has a specific purpose and requires careful attention. Double-check each entry against your financial records. Ensure that the totals add up correctly and that your personal details match those on file with the IRS. Common Mistakes to Avoid Mistakes can include incorrect taxpayer identification numbers, mismatched names, or incorrect interest amounts. Thoroughly review the form before submission to prevent any issues with your taxes. Differentiating Taxable and Non-taxable Interest IncomeThe instructions for the 1099-INT form help differentiate between taxable and non-taxable interest. Not all interest income must be included in your taxable income, so knowing the difference is key. Identifying Taxable InterestMost interest is taxable, such as that earned from banks or from loans you've provided. Ensure you report it accurately on your tax return. Recognizing Exclusions and ExceptionsCertain types of interest may be exempt from taxes, like some government bonds or qualified education savings accounts. Knowing these exceptions is vital to avoid overpaying taxes. Impact on Tax Liability Correctly identifying and reporting your interest will impact how much you owe or how large your refund might be. Make sure to follow IRS instructions for Form 1099-INT closely to determine what applies to your situation. Electronic Options for 1099-INT Submission E-filing your taxes has become a widely accepted method of submission, and this includes forms like the 1099-INT. E-filing is often faster and more secure than paper filing. It can also reduce errors since many e-filing systems have built-in checks for common mistakes. Multiple options exist for e-filing, ranging from IRS-approved websites to tax preparation software. Ensure the platform you choose supports e-filing for the 1099-INT. Step-by-Step Guide to E-Filing E-filing usually involves creating an account, entering your tax information into the prescribed fields, and then submitting your form electronically. The system will generally guide you through this process, minimizing confusion. If you are having trouble or have questions about your 1099-INT, resources are available to help. For example, our website offers comprehensive IRS Form 1099-INT instructions and answers to common questions. Addressing Challenges in Understanding the Form If instructions for the 1099-INT are still unclear or if there are unique circumstances not covered by general guidance, it may be beneficial to consult a tax professional. They can provide personalized assistance tailored to your specific tax situation. While dealing with tax forms can be overwhelming, having a clear understanding of instructions for the 1099-INT can simplify the process and ensure accuracy in tax reporting. Always take your time, check your work, and don't hesitate to seek professional help when necessary. Fill Now -

![image]() Free 1099-INT Form If you've earned interest from bank accounts or investments throughout the fiscal year, you're likely familiar with the need to report this income to the Internal Revenue Service (IRS) using Form 1099-INT. Accessing a free 1099-INT template carries several unspoken benefits that are crucial for both individuals and businesses to understand. Cost Savings and Efficiency When you use a free printable 1099-INT tax form, one of the most immediate benefits is cost savings. Instead of purchasing software or paying a professional to handle your tax forms, you can effectively manage your interest income documentation at no cost. Moreover, these templates are designed with simplicity in mind, allowing you to save time by quickly inputting your data without needing specialized knowledge or training. Accessibility of Form 1099-INT and Widespread Usage Another significant benefit is the ease of access. With a 1099-INT form for free, you can download and print as many copies as you need directly from your computer. This is particularly advantageous for entities managing multiple accounts or filing on behalf of clients. The widespread usage of these forms means that they are recognized and accepted by tax authorities, eliminating any concerns about the legitimacy of your filings. Potential Pitfalls on Form 1099-INT to Be Aware Of While there are many perks to using a free Form 1099-INT, it's also essential to be wary of potential pitfalls. Precision is key when filling out these forms, as any errors could lead to penalties or an audit. It's critical to double-check all information for accuracy before submission and ensure that the form aligns with the latest IRS guidelines, which may change from year to year. Unique Features and Options Utilizing a free fillable 1099-INT form provides useful features and options that can cater to various filing needs. Customization FeaturesYou can often find customization options in a 1099-INT form to download for free. These features allow you to tailor the form to match specific requirements, such as adding branding elements if you're a business or adjusting fields based on the type of interest income being reported. Bulk Filing CapabilitiesFor those handling multiple filings, these free templates often support bulk processing, which streamlines the procedure significantly. Whether dealing with numerous clients or personal investments, this capability can simplify tax season considerably. Integrations with Tax SoftwareMany free templates offer integrations with popular tax software programs. This feature simplifies transferring data directly into your tax return, ensuring that all numerical values are accurate and that your reports maintain consistency across all documents. IRS Form 1099-INT: Data Security and Compliance When working with sensitive financial data, keeping information secure and compliant with regulations is a top priority. A crucial consideration when choosing a free printable 1099-INT form is its adherence to privacy laws. Providers of these templates must stay abreast of current regulations to ensure user data is managed properly. Data Encryption and Storage ProtocolsDiligent providers incorporate data encryption and secure storage protocols. These security measures protect against unauthorized access, ensuring that personal and financial details remain confidential throughout the filing process. Mitigating Risks of Data BreachesTo minimize risks associated with data breaches, select a template from a trusted source. The right provider will have robust security systems in place and be transparent about their practices, giving users peace of mind while handling their tax reporting obligations. Federal Form 1099-INT & Lesser-Known Reporting Scenarios In addition to straightforward interest income reports, there are several lesser-known situations where reporting via the 1099-INT is necessary. Reporting on Joint Accounts and Multiple OwnersWhen interest is earned on joint accounts or accounts with multiple owners, it's important to know how to attribute the income correctly. IRS guidelines provide specific instructions for these scenarios. Handling Recipient Changes Mid-YearIt's not uncommon for account ownership or beneficiary details to change within a year. In such cases, figuring out who is responsible for reporting the interest can be complex. Addressing Complications in Reporting Inherited AccountsInherited accounts require careful consideration during tax reporting. The initial recipient may have different obligations than a person who inherits an account midway through the year. Special Considerations for Specific Industries Various industries encounter unique challenges when reporting interest income. Financial InstitutionsBanks and other financial institutions regularly provide interest income information to account holders. They must abide by stringent regulations while doing so. Fintech CompaniesFintech companies often facilitate interest-bearing transactions and must ensure their reporting is clear and compliant, especially since they may offer unconventional savings vehicles. Cryptocurrency and Interest Income ReportingWith the advent of crypto assets that generate interest, entities must understand how to report this income correctly using the free 1099-INT form. Beyond Interest Income: Additional Considerations While Form 1099-INT is primarily for reporting interest income, there are other types of income that may be relevant. Reporting Bonuses and RewardsBonuses or promotional rewards that equate to monetary value may be considered taxable interest income and could require reporting. Uncommon Sources of Interest IncomeInterest can come from less common sources like certain types of life insurance contracts or seller-financed mortgages, which may necessitate specific reporting lines on Form 1099-INT. Navigating Complex Interest StructuresCertain financial products feature complex interest structures, like tiered savings accounts or variable-rate bonds, making accurate reporting critical. Leveraging Advanced Features of Electronic FilingThe 1099-INT for free isn't just about filling out and printing forms—taking advantage of electronics offers further benefits. Electronic filing systems often include advanced features such as auto-calculation of totals and checksum validations to reduce errors. Moreover, e-filing platforms connected with IRS systems can provide immediate feedback on filing status, acknowledgments of receipt, and even notifications of potential issues, allowing taxpayers to address problems promptly. To conclude, finding a reliable source to get the 1099-INT form free and printable can immensely simplify your tax preparation process while also providing cost savings and enhancing efficiency. Nevertheless, it's essential to pay close attention to detail when completing these forms and stay informed about current regulations to ensure accurate and compliant filings. Fill Now

Free 1099-INT Form If you've earned interest from bank accounts or investments throughout the fiscal year, you're likely familiar with the need to report this income to the Internal Revenue Service (IRS) using Form 1099-INT. Accessing a free 1099-INT template carries several unspoken benefits that are crucial for both individuals and businesses to understand. Cost Savings and Efficiency When you use a free printable 1099-INT tax form, one of the most immediate benefits is cost savings. Instead of purchasing software or paying a professional to handle your tax forms, you can effectively manage your interest income documentation at no cost. Moreover, these templates are designed with simplicity in mind, allowing you to save time by quickly inputting your data without needing specialized knowledge or training. Accessibility of Form 1099-INT and Widespread Usage Another significant benefit is the ease of access. With a 1099-INT form for free, you can download and print as many copies as you need directly from your computer. This is particularly advantageous for entities managing multiple accounts or filing on behalf of clients. The widespread usage of these forms means that they are recognized and accepted by tax authorities, eliminating any concerns about the legitimacy of your filings. Potential Pitfalls on Form 1099-INT to Be Aware Of While there are many perks to using a free Form 1099-INT, it's also essential to be wary of potential pitfalls. Precision is key when filling out these forms, as any errors could lead to penalties or an audit. It's critical to double-check all information for accuracy before submission and ensure that the form aligns with the latest IRS guidelines, which may change from year to year. Unique Features and Options Utilizing a free fillable 1099-INT form provides useful features and options that can cater to various filing needs. Customization FeaturesYou can often find customization options in a 1099-INT form to download for free. These features allow you to tailor the form to match specific requirements, such as adding branding elements if you're a business or adjusting fields based on the type of interest income being reported. Bulk Filing CapabilitiesFor those handling multiple filings, these free templates often support bulk processing, which streamlines the procedure significantly. Whether dealing with numerous clients or personal investments, this capability can simplify tax season considerably. Integrations with Tax SoftwareMany free templates offer integrations with popular tax software programs. This feature simplifies transferring data directly into your tax return, ensuring that all numerical values are accurate and that your reports maintain consistency across all documents. IRS Form 1099-INT: Data Security and Compliance When working with sensitive financial data, keeping information secure and compliant with regulations is a top priority. A crucial consideration when choosing a free printable 1099-INT form is its adherence to privacy laws. Providers of these templates must stay abreast of current regulations to ensure user data is managed properly. Data Encryption and Storage ProtocolsDiligent providers incorporate data encryption and secure storage protocols. These security measures protect against unauthorized access, ensuring that personal and financial details remain confidential throughout the filing process. Mitigating Risks of Data BreachesTo minimize risks associated with data breaches, select a template from a trusted source. The right provider will have robust security systems in place and be transparent about their practices, giving users peace of mind while handling their tax reporting obligations. Federal Form 1099-INT & Lesser-Known Reporting Scenarios In addition to straightforward interest income reports, there are several lesser-known situations where reporting via the 1099-INT is necessary. Reporting on Joint Accounts and Multiple OwnersWhen interest is earned on joint accounts or accounts with multiple owners, it's important to know how to attribute the income correctly. IRS guidelines provide specific instructions for these scenarios. Handling Recipient Changes Mid-YearIt's not uncommon for account ownership or beneficiary details to change within a year. In such cases, figuring out who is responsible for reporting the interest can be complex. Addressing Complications in Reporting Inherited AccountsInherited accounts require careful consideration during tax reporting. The initial recipient may have different obligations than a person who inherits an account midway through the year. Special Considerations for Specific Industries Various industries encounter unique challenges when reporting interest income. Financial InstitutionsBanks and other financial institutions regularly provide interest income information to account holders. They must abide by stringent regulations while doing so. Fintech CompaniesFintech companies often facilitate interest-bearing transactions and must ensure their reporting is clear and compliant, especially since they may offer unconventional savings vehicles. Cryptocurrency and Interest Income ReportingWith the advent of crypto assets that generate interest, entities must understand how to report this income correctly using the free 1099-INT form. Beyond Interest Income: Additional Considerations While Form 1099-INT is primarily for reporting interest income, there are other types of income that may be relevant. Reporting Bonuses and RewardsBonuses or promotional rewards that equate to monetary value may be considered taxable interest income and could require reporting. Uncommon Sources of Interest IncomeInterest can come from less common sources like certain types of life insurance contracts or seller-financed mortgages, which may necessitate specific reporting lines on Form 1099-INT. Navigating Complex Interest StructuresCertain financial products feature complex interest structures, like tiered savings accounts or variable-rate bonds, making accurate reporting critical. Leveraging Advanced Features of Electronic FilingThe 1099-INT for free isn't just about filling out and printing forms—taking advantage of electronics offers further benefits. Electronic filing systems often include advanced features such as auto-calculation of totals and checksum validations to reduce errors. Moreover, e-filing platforms connected with IRS systems can provide immediate feedback on filing status, acknowledgments of receipt, and even notifications of potential issues, allowing taxpayers to address problems promptly. To conclude, finding a reliable source to get the 1099-INT form free and printable can immensely simplify your tax preparation process while also providing cost savings and enhancing efficiency. Nevertheless, it's essential to pay close attention to detail when completing these forms and stay informed about current regulations to ensure accurate and compliant filings. Fill Now -

![image]() 1099-INT Form Sample Understanding the sample of the 1099-INT form is essential for accurately reporting interest income on your taxes. This document captures various types of interest earned over a year. Below is a breakdown of its key sections. Section 1: Personal InformationThis initial section is crucial as it contains your personal details, which must be correct to ensure the IRS can match the form to your tax records. Section 2: Interest IncomeThis part details the interest you've earned. It is vital as it directly impacts the income you must report. Section 3: Payer InformationThe third section provides information about the payer who has given you the interest. This info helps track where your interest income came from. Understanding Boxes and Fields Each box on Form 1099-INT has a specific purpose and requires certain data. It's important to understand what each box represents to fill out the form accurately. Sample 1099-INT Form Overview A sample of Form 1099-INT can be immensely helpful in visualizing where each piece of information should go. Seeing a visual example can help clarify any confusion about how to report your interest income correctly. Personal Information Section: A Closer Look Personal details must be recorded with care. The following data is requested: Name and Address of RecipientYour full legal name and current address are entered in this field, ensuring the IRS and the payer can reach you if needed. Social Security Number (SSN) or Taxpayer Identification Number (TIN)This is your unique identifier for tax purposes. Errors here can lead to processing delays or mismatches in records. Common Mistakes and How to Avoid ThemMaking sure the personal information is accurate is pivotal. Incorrect details can delay your refund or even result in penalties. Taking a look at a 1099-INT sample form can help you better understand what the proper entry of personal information should look like. Interest Income Section: Real-Life Scenarios Types of Interest IncomeInterest comes in different forms, and it's important to record each type correctly on your form: Ordinary InterestThis is the regular interest you earn from bank accounts or loans you have provided. U.S. Savings Bond InterestA specific type of interest that accrues from government-issued savings bonds. Early Withdrawal PenaltiesIf you've incurred a penalty for withdrawing funds early from a savings account, this is deductible and should be noted, too. Illustrative Examples of Interest Income Calculation Seeing examples can help make sense of how to calculate different types of interest income for reporting purposes. An illustration of the interest income section provides clarity on where each type of interest should be reported on the 1099-INT form sample. Payer Information Section: Navigating Details Payer's Name, Address, and TINThe information about the institution or individual who paid you interest is entered here. Account Number and Other IdentifiersIf applicable, including the account number increases accuracy and helps track multiple accounts. Tips for Accurate ReportingEnsure all data matches your records, double-check numbers, and verify details with the payer if uncertain. Sample Payer Information Section IllustrationUsing a sample of the completed 1099-INT form can guide you through filling out payer details accordingly. Common Scenarios and Exceptions Joint Accounts and ReportingWith joint accounts, generally, only one person needs to report the interest, but understanding when and how is key. Exceptions for Certain Types of AccountsThere are exceptions for accounts such as IRAs or tax-exempt organizations, which have different reporting rules. Special Considerations for Specific SituationsCertain interest incomes, like those from foreign sources or bond premiums, may need careful handling on your Form 1099-INT, Interest Income, sample. Sample Illustrations for Different ScenariosExamples of completed forms for different account types and situations can provide insight into how to handle your own reporting accurately. Concluding this overview, ensure that you have access to reliable resources, such as a pristine 1099-INT form sample, before attempting to fill it out. This can help you avoid costly mistakes and ensure compliance with IRS requirements. Whether you're an individual or business entity receiving interest income, proper attention to detail and an understanding of how to apply information to a form are keystones of correct tax reporting practices. Fill Now

1099-INT Form Sample Understanding the sample of the 1099-INT form is essential for accurately reporting interest income on your taxes. This document captures various types of interest earned over a year. Below is a breakdown of its key sections. Section 1: Personal InformationThis initial section is crucial as it contains your personal details, which must be correct to ensure the IRS can match the form to your tax records. Section 2: Interest IncomeThis part details the interest you've earned. It is vital as it directly impacts the income you must report. Section 3: Payer InformationThe third section provides information about the payer who has given you the interest. This info helps track where your interest income came from. Understanding Boxes and Fields Each box on Form 1099-INT has a specific purpose and requires certain data. It's important to understand what each box represents to fill out the form accurately. Sample 1099-INT Form Overview A sample of Form 1099-INT can be immensely helpful in visualizing where each piece of information should go. Seeing a visual example can help clarify any confusion about how to report your interest income correctly. Personal Information Section: A Closer Look Personal details must be recorded with care. The following data is requested: Name and Address of RecipientYour full legal name and current address are entered in this field, ensuring the IRS and the payer can reach you if needed. Social Security Number (SSN) or Taxpayer Identification Number (TIN)This is your unique identifier for tax purposes. Errors here can lead to processing delays or mismatches in records. Common Mistakes and How to Avoid ThemMaking sure the personal information is accurate is pivotal. Incorrect details can delay your refund or even result in penalties. Taking a look at a 1099-INT sample form can help you better understand what the proper entry of personal information should look like. Interest Income Section: Real-Life Scenarios Types of Interest IncomeInterest comes in different forms, and it's important to record each type correctly on your form: Ordinary InterestThis is the regular interest you earn from bank accounts or loans you have provided. U.S. Savings Bond InterestA specific type of interest that accrues from government-issued savings bonds. Early Withdrawal PenaltiesIf you've incurred a penalty for withdrawing funds early from a savings account, this is deductible and should be noted, too. Illustrative Examples of Interest Income Calculation Seeing examples can help make sense of how to calculate different types of interest income for reporting purposes. An illustration of the interest income section provides clarity on where each type of interest should be reported on the 1099-INT form sample. Payer Information Section: Navigating Details Payer's Name, Address, and TINThe information about the institution or individual who paid you interest is entered here. Account Number and Other IdentifiersIf applicable, including the account number increases accuracy and helps track multiple accounts. Tips for Accurate ReportingEnsure all data matches your records, double-check numbers, and verify details with the payer if uncertain. Sample Payer Information Section IllustrationUsing a sample of the completed 1099-INT form can guide you through filling out payer details accordingly. Common Scenarios and Exceptions Joint Accounts and ReportingWith joint accounts, generally, only one person needs to report the interest, but understanding when and how is key. Exceptions for Certain Types of AccountsThere are exceptions for accounts such as IRAs or tax-exempt organizations, which have different reporting rules. Special Considerations for Specific SituationsCertain interest incomes, like those from foreign sources or bond premiums, may need careful handling on your Form 1099-INT, Interest Income, sample. Sample Illustrations for Different ScenariosExamples of completed forms for different account types and situations can provide insight into how to handle your own reporting accurately. Concluding this overview, ensure that you have access to reliable resources, such as a pristine 1099-INT form sample, before attempting to fill it out. This can help you avoid costly mistakes and ensure compliance with IRS requirements. Whether you're an individual or business entity receiving interest income, proper attention to detail and an understanding of how to apply information to a form are keystones of correct tax reporting practices. Fill Now -

![image]() File Form 1099-INT If you've received interest income during the year, it's crucial to understand the significance of IRS Form 1099-INT. This document is used by banks and other financial institutions to report the amount of interest they've paid to investors. In turn, it helps individuals and entities report this income to the IRS accurately. If you're earning interest from savings accounts, investments, or loans you have made to others, you may likely need to deal with a 1099-INT form. Target Audience of Form 1099-INT The information we're sharing here is vital for anyone who has earned interest income, businesses that pay interest on client accounts, or tax professionals who assist with financial reporting. Understanding how to file Form 1099-INT correctly is important for compliance and avoiding potential penalties. Overview of the 1099-INT Form Filing Process Filing the 1099-INT form involves several steps, from gathering the necessary information to submitting the form to the IRS. Each stage requires attention to detail to ensure that all data is accurate and that the form is filed on time. Preparing Form 1099-INT for Filing First thing first, you need to gather the necessary information. Recipient InformationYou'll need the name, address, and taxpayer identification number (TIN) for each person who received interest payments from you. Interest Income DetailsRecord the total amount of interest paid to each individual or entity throughout the tax year. Payer InformationAs the one reporting the interest, ensure that your business name, address, and TIN are correct on the form. B. Reviewing Applicable Thresholds It's important to note that not all interest payments require a 1099-INT. Review the thresholds set by the IRS to understand when you must report interest income. Typically, if you pay at least $10 in interest to an individual, you need to report it. C. Identifying Special Scenarios and Exceptions Certain situations, such as interest paid in foreign countries or to non-resident aliens, may have special reporting requirements. Be aware of these exceptions to avoid mistakes during the filing process. Form 1099-INT & Electronic Filing Options Advantages of E-FilingWhen you choose to e-file the 1099-INT, you benefit from faster processing times, reduced errors, and immediate confirmation of receipt. Electronic submissions also save time and resources, making it an environmentally friendly option. Choosing the Right E-Filing PlatformSelecting a reliable and secure platform to file the 1099-INT electronically is crucial. Look for a service that provides clear instructions, help resources, and robust customer support. Step-by-Step Guide to E-FilingFiling the 1099-INT online is a straightforward process that includes creating an account on the e-filing platform, entering your information accurately, reviewing for errors, and transmitting the form directly to the IRS through the approved electronic system. Submitting the 1099-INT Form Remember that you have to file the 1099-INT form to both the recipient and the IRS by January 31st, following the tax year in which interest was paid. Missing this deadline can result in penalties, so mark it on your calendar. While paper filing is still accepted, electronic submissions are becoming the norm due to their efficiency. When you file the 1099-INT online to the IRS, you not only expedite your filing process but also contribute to a more streamlined tax system. After submitting your form electronically, you should receive a confirmation email or message indicating that your filing has been accepted. Keep this confirmation as proof of your complaint submission. Addressing Common Challenges Troubleshooting Technical IssuesIf you encounter issues while trying to file the 1099-INT online, check for any system updates or maintenance periods affecting the e-filing platform. Resolving Errors and RejectionsIn case of errors or rejections after your submission, carefully review the rejection notice to understand the problem and take appropriate corrective action immediately. Seeking Professional AssistanceIf you're unsure about any aspect of how to file the 1099-INT to the IRS or if you face complicated issues that can't be easily resolved, don't hesitate to seek help from a tax professional. Post-Filing Considerations Retaining Copies for Record-KeepingIt's essential to keep copies of your filed 1099-INTs for at least three years after the due date of the return. This documentation can be vital in case of any future inquiries or audits. Preparing for Potential Audits or InquiriesHaving detailed records will prepare you for any potential audits or inquiries from the IRS. Organize your documents so that they are easily accessible if required. Staying Informed About Updates and ChangesLastly, tax laws and filing requirements can change. Stay informed about any updates that might affect how your IRS Form 1099-INT to file online in future tax years. Fill Now

File Form 1099-INT If you've received interest income during the year, it's crucial to understand the significance of IRS Form 1099-INT. This document is used by banks and other financial institutions to report the amount of interest they've paid to investors. In turn, it helps individuals and entities report this income to the IRS accurately. If you're earning interest from savings accounts, investments, or loans you have made to others, you may likely need to deal with a 1099-INT form. Target Audience of Form 1099-INT The information we're sharing here is vital for anyone who has earned interest income, businesses that pay interest on client accounts, or tax professionals who assist with financial reporting. Understanding how to file Form 1099-INT correctly is important for compliance and avoiding potential penalties. Overview of the 1099-INT Form Filing Process Filing the 1099-INT form involves several steps, from gathering the necessary information to submitting the form to the IRS. Each stage requires attention to detail to ensure that all data is accurate and that the form is filed on time. Preparing Form 1099-INT for Filing First thing first, you need to gather the necessary information. Recipient InformationYou'll need the name, address, and taxpayer identification number (TIN) for each person who received interest payments from you. Interest Income DetailsRecord the total amount of interest paid to each individual or entity throughout the tax year. Payer InformationAs the one reporting the interest, ensure that your business name, address, and TIN are correct on the form. B. Reviewing Applicable Thresholds It's important to note that not all interest payments require a 1099-INT. Review the thresholds set by the IRS to understand when you must report interest income. Typically, if you pay at least $10 in interest to an individual, you need to report it. C. Identifying Special Scenarios and Exceptions Certain situations, such as interest paid in foreign countries or to non-resident aliens, may have special reporting requirements. Be aware of these exceptions to avoid mistakes during the filing process. Form 1099-INT & Electronic Filing Options Advantages of E-FilingWhen you choose to e-file the 1099-INT, you benefit from faster processing times, reduced errors, and immediate confirmation of receipt. Electronic submissions also save time and resources, making it an environmentally friendly option. Choosing the Right E-Filing PlatformSelecting a reliable and secure platform to file the 1099-INT electronically is crucial. Look for a service that provides clear instructions, help resources, and robust customer support. Step-by-Step Guide to E-FilingFiling the 1099-INT online is a straightforward process that includes creating an account on the e-filing platform, entering your information accurately, reviewing for errors, and transmitting the form directly to the IRS through the approved electronic system. Submitting the 1099-INT Form Remember that you have to file the 1099-INT form to both the recipient and the IRS by January 31st, following the tax year in which interest was paid. Missing this deadline can result in penalties, so mark it on your calendar. While paper filing is still accepted, electronic submissions are becoming the norm due to their efficiency. When you file the 1099-INT online to the IRS, you not only expedite your filing process but also contribute to a more streamlined tax system. After submitting your form electronically, you should receive a confirmation email or message indicating that your filing has been accepted. Keep this confirmation as proof of your complaint submission. Addressing Common Challenges Troubleshooting Technical IssuesIf you encounter issues while trying to file the 1099-INT online, check for any system updates or maintenance periods affecting the e-filing platform. Resolving Errors and RejectionsIn case of errors or rejections after your submission, carefully review the rejection notice to understand the problem and take appropriate corrective action immediately. Seeking Professional AssistanceIf you're unsure about any aspect of how to file the 1099-INT to the IRS or if you face complicated issues that can't be easily resolved, don't hesitate to seek help from a tax professional. Post-Filing Considerations Retaining Copies for Record-KeepingIt's essential to keep copies of your filed 1099-INTs for at least three years after the due date of the return. This documentation can be vital in case of any future inquiries or audits. Preparing for Potential Audits or InquiriesHaving detailed records will prepare you for any potential audits or inquiries from the IRS. Organize your documents so that they are easily accessible if required. Staying Informed About Updates and ChangesLastly, tax laws and filing requirements can change. Stay informed about any updates that might affect how your IRS Form 1099-INT to file online in future tax years. Fill Now -

![image]() IRS Form 1099-INT: Interest Income When you place your money in a savings account or invest it in certificates of deposit, bonds, or other financial products, you may earn additional money over time. This earnings is known as interest income. It is the payment you receive for allowing a bank, corporation, or government to use your money. Overview of the 1099-INT Tax Form Interest income is not just a benefit to your savings; it is also subject to taxes. The Internal Revenue Service (IRS) requires most payers of this type of income to report it using a particular form named the IRS Form 1099-INT (Interest Income). This document serves as an official record of the interest you've earned during the year from various financial sources. Importance of Reporting Interest Income Reporting interest income is crucial because it is part of your income that is subject to tax according to the law. Failure to report it can lead to penalties and interest on taxes owed. Furthermore, accurate reporting helps ensure you are paying the correct amount of tax, potentially avoiding both underpayment and overpayment. Form 1099-INT & Types of Interest Income Savings Account InterestThe money paid to you by the bank for keeping your money in a savings account. Certificate of Deposit (CD) InterestThis is the fixed interest rate earned from investing in a CD for a specified period. Bonds and Treasury Securities InterestInterest received from investing in government or corporate bonds. Interest from Loans and Notes ReceivableWhen you lend money, the interest you charge is considered interest income. Taxable vs. Tax-Exempt Interest Income While most interest income is taxable and should be included on your tax return, some types may be exempt from federal tax. Certain municipal bonds, for example, may offer tax-exempt interest income. However, tax exemption does not mean it should not be reported; it still needs to be listed on your tax return, even though it may not be taxed. How Interest Income Affects Your Tax Bracket Your tax bracket determines how much income tax you owe. Every dollar of 1099-INT taxable income adds to your total income, which could potentially push you into a higher tax bracket. This means it's not just about how much you earn in interest, but also how those earnings affect your overall tax situation. The 1099-INT Tax Form Explained The 1099-INT form serves as a detailed record provided by payers of interest income such as banks and other financial institutions. This document is integral for both the IRS and taxpayers because it includes information needed to fill out income tax returns properly. If you have received interest income that totals more than $10 during the tax year, you should expect to receive a 1099-INT from the payer. It's crucial to understand that even if you do not receive this document, perhaps due to an error or oversight, you are still responsible for reporting all interest earnings when you file your taxes. Components of the 1099-INT Form The 1099-INT interest income form contains several pieces of important information. These specifics include the amount of interest you earned throughout the year, any penalties you paid, and even details on foreign tax paid or withheld. Recognizing all these different components is vital for correctly reporting your interest income. Tips on Handling Form 1099-INT Income Finding and Utilizing a Form 1099-INT for Interest IncomeTo properly report your interest earnings, you may need a copy of the form. Getting a blank 1099-INT form is straightforward; they are available through the IRS website or at office supply stores. Alternatively, many online providers offer downloadable and printable versions When and How to File Your 1099-INT Interest Income ReportingTypically, payers must send out Form 1099-INT by January 31st. Upon receiving it, review it for accuracy before including the reported figures on your tax return. The form doesn't get sent directly to the IRS by the taxpayer; instead, the information from the form is used to complete relevant sections of your tax return. Previewing a Form 1099-INT Interest Income SampleLooking at a sample can be extremely helpful in understanding what to expect and how to interpret the information presented in your own form. Samples are often accompanied by detailed instructions to guide taxpayers on where and how to report interest income on their tax filings. Dealing with forms during the tax season can feel overwhelming. However, it's important to tackle them one at a time. Remember that the information from your 1099-INT directly impacts your taxable income for the year. Should you find yourself puzzled or uncertain, reaching out to a tax professional for guidance is always a smart move. In summary, the handling of your 1099-INT interest income involves receiving the form from your payer, understanding its contents, and using that information to accurately report and file your taxes. Be diligent about tracking interest income throughout the year and ensure your forms match your records; this way, you can rest easy knowing that your taxes are accurate and compliant with IRS regulations. Fill Now

IRS Form 1099-INT: Interest Income When you place your money in a savings account or invest it in certificates of deposit, bonds, or other financial products, you may earn additional money over time. This earnings is known as interest income. It is the payment you receive for allowing a bank, corporation, or government to use your money. Overview of the 1099-INT Tax Form Interest income is not just a benefit to your savings; it is also subject to taxes. The Internal Revenue Service (IRS) requires most payers of this type of income to report it using a particular form named the IRS Form 1099-INT (Interest Income). This document serves as an official record of the interest you've earned during the year from various financial sources. Importance of Reporting Interest Income Reporting interest income is crucial because it is part of your income that is subject to tax according to the law. Failure to report it can lead to penalties and interest on taxes owed. Furthermore, accurate reporting helps ensure you are paying the correct amount of tax, potentially avoiding both underpayment and overpayment. Form 1099-INT & Types of Interest Income Savings Account InterestThe money paid to you by the bank for keeping your money in a savings account. Certificate of Deposit (CD) InterestThis is the fixed interest rate earned from investing in a CD for a specified period. Bonds and Treasury Securities InterestInterest received from investing in government or corporate bonds. Interest from Loans and Notes ReceivableWhen you lend money, the interest you charge is considered interest income. Taxable vs. Tax-Exempt Interest Income While most interest income is taxable and should be included on your tax return, some types may be exempt from federal tax. Certain municipal bonds, for example, may offer tax-exempt interest income. However, tax exemption does not mean it should not be reported; it still needs to be listed on your tax return, even though it may not be taxed. How Interest Income Affects Your Tax Bracket Your tax bracket determines how much income tax you owe. Every dollar of 1099-INT taxable income adds to your total income, which could potentially push you into a higher tax bracket. This means it's not just about how much you earn in interest, but also how those earnings affect your overall tax situation. The 1099-INT Tax Form Explained The 1099-INT form serves as a detailed record provided by payers of interest income such as banks and other financial institutions. This document is integral for both the IRS and taxpayers because it includes information needed to fill out income tax returns properly. If you have received interest income that totals more than $10 during the tax year, you should expect to receive a 1099-INT from the payer. It's crucial to understand that even if you do not receive this document, perhaps due to an error or oversight, you are still responsible for reporting all interest earnings when you file your taxes. Components of the 1099-INT Form The 1099-INT interest income form contains several pieces of important information. These specifics include the amount of interest you earned throughout the year, any penalties you paid, and even details on foreign tax paid or withheld. Recognizing all these different components is vital for correctly reporting your interest income. Tips on Handling Form 1099-INT Income Finding and Utilizing a Form 1099-INT for Interest IncomeTo properly report your interest earnings, you may need a copy of the form. Getting a blank 1099-INT form is straightforward; they are available through the IRS website or at office supply stores. Alternatively, many online providers offer downloadable and printable versions When and How to File Your 1099-INT Interest Income ReportingTypically, payers must send out Form 1099-INT by January 31st. Upon receiving it, review it for accuracy before including the reported figures on your tax return. The form doesn't get sent directly to the IRS by the taxpayer; instead, the information from the form is used to complete relevant sections of your tax return. Previewing a Form 1099-INT Interest Income SampleLooking at a sample can be extremely helpful in understanding what to expect and how to interpret the information presented in your own form. Samples are often accompanied by detailed instructions to guide taxpayers on where and how to report interest income on their tax filings. Dealing with forms during the tax season can feel overwhelming. However, it's important to tackle them one at a time. Remember that the information from your 1099-INT directly impacts your taxable income for the year. Should you find yourself puzzled or uncertain, reaching out to a tax professional for guidance is always a smart move. In summary, the handling of your 1099-INT interest income involves receiving the form from your payer, understanding its contents, and using that information to accurately report and file your taxes. Be diligent about tracking interest income throughout the year and ensure your forms match your records; this way, you can rest easy knowing that your taxes are accurate and compliant with IRS regulations. Fill Now -